Today’s shoppers are not only overwhelmed by too many choices but are also increasingly pressed for time. A typical shopper spends just a few seconds looking for a specific brand before settling for an alternative. In addition, shoppers make a high level of unplanned purchases, with more than 50% of purchase decisions being made in front of the shelf. In such a scenario, it becomes critical for manufacturers and retailers to optimize both their assortment of products as well as their arrangement on store shelves for maximum impact. Some of the critical questions that manufacturers and retailers need answers to include:

-

Manufacturers:

- How do I maximize volume and margin across a portfolio of products?

- How can I get more of my items on shelf?

- What items should I target for discontinuation?

- What are the greatest incremental opportunities in the market?

- What is the incrementality or cannibalization of my new products?

- How can I maximize category sales?

- What is the optimal assortment for the category and my brand?

-

Retailers:

- How do I attract more customers to my store?

- How do I encourage repeated and more frequent visits?

- What are the categories that provide the most value to my stores?

- Which categories should I expand and contract?

- In what categories do I need to have a private label offering?

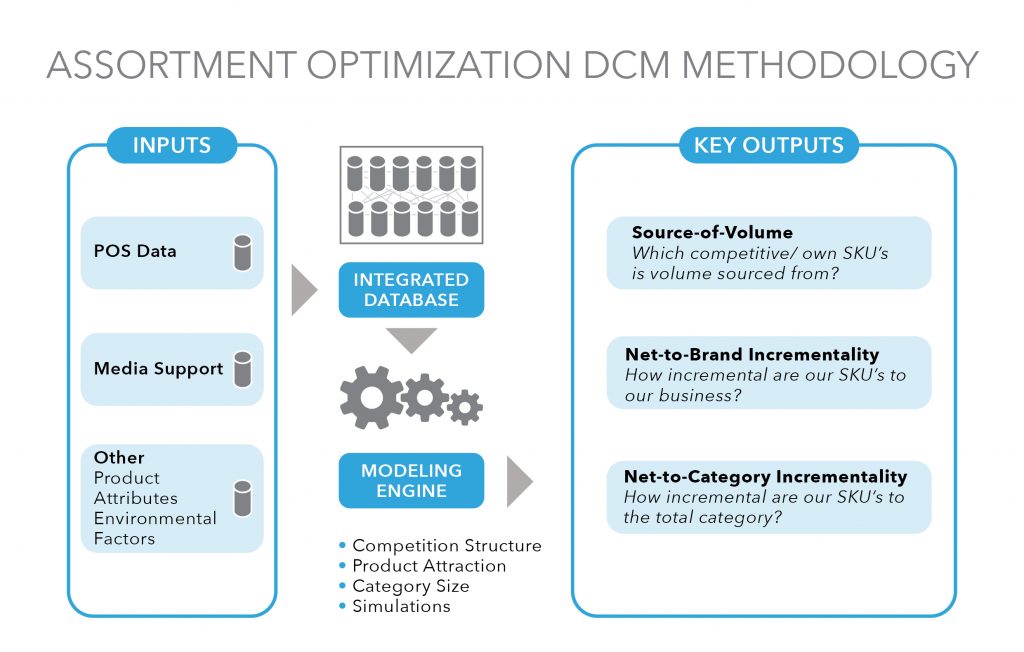

Analytic Edge’s Assortment Optimization solution uses Dynamic Competitive Modeling to simulate the effects of transferred demand and help determine the optimal assortment of products and SKUs that will maximize sales and margins. It analyzes the incrementality of each SKU’s volume to its brand and category, as well as how much volume reflects a switch from other products. This insight helps manufacturers and retailers maximize segment and category sales.

Key Features & Benefits

- Dynamic Competitive Modeling (DCM) methodology leverages historical point of sales data instead of survey data

- Helps optimize portfolio sales and margins by providing insights on how much volume would flow out of the brand or category and how much would flow to a competitors if a SKU was removed.

- Manufacturers can identify SKUs for rationalization to maximize sales

- Retailers can identify SKUs for maximizing category sales